Exactly How a Secured Credit Card Singapore Can Aid You Rebuild Your Credit Score

Exactly How a Secured Credit Card Singapore Can Aid You Rebuild Your Credit Score

Blog Article

Exploring Options: Can Former Bankrupts Secure Debt Cards Complying With Discharge?

Browsing the economic landscape post-bankruptcy can be a difficult job for individuals aiming to rebuild their credit. One typical inquiry that occurs is whether previous bankrupts can successfully acquire bank card after their discharge. The solution to this questions includes a complex exploration of different variables, from charge card choices customized to this demographic to the impact of previous financial choices on future creditworthiness. By understanding the ins and outs of this process, individuals can make enlightened choices that may lead the way for an extra secure financial future.

Understanding Credit History Card Options

When considering credit cards post-bankruptcy, people must very carefully assess their requirements and economic circumstance to pick the most suitable choice. Guaranteed credit report cards, for instance, need a cash money deposit as collateral, making them a sensible choice for those looking to reconstruct their credit rating background.

In addition, individuals ought to pay close focus to the annual percent rate (APR), poise period, yearly fees, and benefits programs used by different credit history cards. By comprehensively assessing these variables, individuals can make enlightened choices when selecting a debt card that lines up with their financial goals and circumstances.

Factors Impacting Approval

When using for credit cards post-bankruptcy, comprehending the aspects that influence authorization is vital for people seeking to restore their financial standing. Complying with an insolvency, credit rating ratings commonly take a hit, making it more difficult to qualify for standard credit cards. Demonstrating responsible financial behavior post-bankruptcy, such as paying costs on time and maintaining credit rating usage low, can also positively influence credit history card approval.

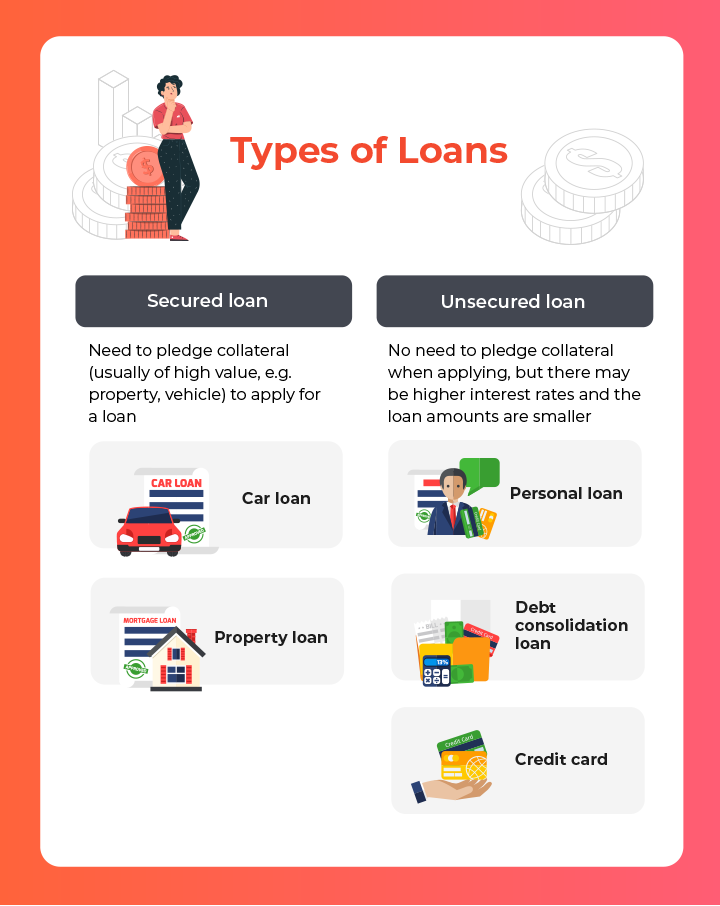

Safe Vs. Unsecured Cards

Safe credit scores cards call for a cash deposit as security, usually equal to the credit limitation expanded by the provider. These cards generally use higher credit report restrictions and lower rate of interest prices for individuals with great debt scores. Inevitably, the choice between protected and unprotected debt cards depends on the individual's economic situation and debt goals.

Building Credit History Sensibly

To properly rebuild credit scores post-bankruptcy, establishing a pattern of responsible credit scores usage is vital. Additionally, keeping credit rating card balances reduced family member to the credit score limitation can positively influence credit score scores.

Another technique for developing debt responsibly is to keep track of credit report records regularly. By evaluating credit report records for mistakes or indicators of identification burglary, people can resolve concerns promptly and maintain the accuracy of their credit rating history.

Reaping Long-Term Advantages

Having developed a structure of accountable credit score monitoring post-bankruptcy, people can now concentrate on leveraging their boosted credit reliability for long-lasting financial advantages. By our website continually making on-time repayments, keeping credit application reduced, and monitoring their credit records for accuracy, previous bankrupts can slowly restore their credit rating. As their credit history boost, they may come to be eligible for far better charge card provides with reduced rates of interest and higher credit limitations.

Gaining lasting benefits from improved creditworthiness prolongs past simply credit history cards. In addition, a favorable credit scores profile can improve task leads, as some companies may check credit score records as component of the hiring process.

Final Thought

In final thought, former bankrupt individuals might have problem protecting charge card adhering to discharge, yet there are choices available to assist rebuild credit rating. Recognizing the different sorts of credit report cards, elements influencing approval, and the importance of accountable charge card usage can help individuals in this situation. By choosing the right card and Get More Info using it responsibly, former bankrupts can gradually improve their credit report and reap the long-term advantages of having accessibility to credit.

Showing liable economic actions post-bankruptcy, such as paying costs on time and maintaining credit report use low, can also positively affect debt look at this web-site card authorization. Furthermore, keeping credit scores card balances reduced family member to the credit report limitation can positively impact debt ratings. By regularly making on-time payments, maintaining credit score use low, and checking their credit report reports for precision, former bankrupts can progressively reconstruct their credit history ratings. As their credit score scores increase, they might become qualified for better credit card uses with lower rate of interest rates and greater credit history limits.

Comprehending the different types of credit cards, variables impacting authorization, and the importance of liable credit history card usage can aid individuals in this circumstance. secured credit card singapore.

Report this page